Listen to Podcast of the Show

Richard and Joe welcomed David Enrich, the Finance Editor at the New York Times and author of The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. He previously was the Financial Enterprise Editor of the Wall Street Journal, heading a team of investigative reporters. Before that, he was the Journal’s European Banking Editor, based in London, and a Journal reporter in New York. Enrich has received numerous journalism awards, including in 2012 an Overseas Press Club award for coverage of the European debt crisis, a George Polk Award for coverage of insider trading, two SABEW awards and a Gerald Loeb Award for feature writing for “The Unraveling of Tom Hayes.” Enrich was also part of teams of Journal reporters who were finalists for Pulitzer Prizes in 2009 and 2011.

Richard and Joe welcomed David Enrich, the Finance Editor at the New York Times and author of The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. He previously was the Financial Enterprise Editor of the Wall Street Journal, heading a team of investigative reporters. Before that, he was the Journal’s European Banking Editor, based in London, and a Journal reporter in New York. Enrich has received numerous journalism awards, including in 2012 an Overseas Press Club award for coverage of the European debt crisis, a George Polk Award for coverage of insider trading, two SABEW awards and a Gerald Loeb Award for feature writing for “The Unraveling of Tom Hayes.” Enrich was also part of teams of Journal reporters who were finalists for Pulitzer Prizes in 2009 and 2011.

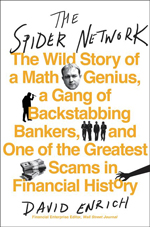

David’s book, The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History, unveils the bizarre and sinister story of how a math genius named Tom Hayes, a handful of outrageous confederates, and a deeply corrupt banking system ignited one of the greatest financial scandals in history. The book was published in March 2017 to critical acclaim. CNBC and the FT recommended the book as one of their summer reads. It was also shortlisted for the 2017 Financial Times and McKinsey Business Book of the Year Award.

David’s book, The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History, unveils the bizarre and sinister story of how a math genius named Tom Hayes, a handful of outrageous confederates, and a deeply corrupt banking system ignited one of the greatest financial scandals in history. The book was published in March 2017 to critical acclaim. CNBC and the FT recommended the book as one of their summer reads. It was also shortlisted for the 2017 Financial Times and McKinsey Business Book of the Year Award.

National Review called The Spider Network “a nonfiction epic…an engrossing, entertaining tale.”

Bloomberg Businessweek called it an “exhaustively reported tale”

Author Harlan Coban praised it as a “terrific nonfiction book.”

The New York Times called it a “vivid depiction of the ethos of the core financial institutions upon which the global economy depends.”

In 2006, an oddball group of bankers, traders and brokers from some of the world’s largest financial institutions made a startling realization: Libor – the London interbank offered rate, which determines the interest rates on trillions in loans worldwide – was set daily by a small group of easily manipulated functionaries, and that they could reap huge profits by nudging it to suit their trading portfolios. Tom Hayes, a brilliant but troubled mathematician, became the lynchpin of a wild alliance that among others included a French trader nicknamed “Gollum”; the broker “Abbo,”; a Kazakh chicken farmer; a broker known as “Village”; an executive called “Clumpy”; and a broker nicknamed “Big Nose.” Eventually known as the “Spider Network,” Haye’s circle generated untold riches – until it all unraveled in spectacularly vicious, backstabbing fashion.

The Spider Network provides insights of the scam as well as a provocative examination of a financial system that was crooked throughout, designed to promote envelope-pushing behavior while shielding higher-ups from the consequences of their subordinates’ rapacious actions.

David grew up in Lexington, Mass., and graduated from Claremont McKenna College in California. He currently lives in New York with his wife and two sons.

Follow Us!